Company Information

Established in 1991 as a subsidiary of Tacirler Holding and obtaining its Full-Service Brokerage Firm licence on 3 February 2015, Tacirler Yatırım is one of the leading brokerage firms in the Turkish capital markets. offers local and foreign individual and institutional investors services such as Corporate Finance, Investment Advisory, Portfolio Management, Market Making, Asset Management and Liquidity Provision, in addition to traditional trading services.

According to TSPB data for June 2025, Tacirler Yatırım, with an asset size of 8.74 billion TL and a net asset size exceeding 3.61 billion TL, is accelerating its efforts to contribute to the Turkish capital market and economy. With its independent structure and leadership identity, it diversifies its services to transform today's changing risk perception into opportunities for investors, closely following technological developments and focusing on providing its customers with the latest technologies.

As one of the brokerage firms with the broadest corporate and individual customer base in the Turkish capital markets, it has six branches in Istanbul (Head Office-Akmerkez, Central, Bakırköy, Erenköy, Kartal, Akatlar), three in Ankara (Ankara, Çukurambar, Çankaya), three in Izmir (Izmir, Karşıyaka and Alsancak), Adana, Antalya, Bodrum, Bursa, Denizli, Gaziantep, Izmit, Karadeniz Ereğli, Kayseri, Marmaris, Mersin, Trabzon and Girne KKTC, Tacirler Yatırım provides services at a total of 25 service points.

Tacirler Yatırım, the first Turkish non-bank capital brokerage firm rated by Fitch Ratings in Turkey, has a long-term national (tur) credit rating of A- (tur) (outlook stable) (https://www.fitchratings.com/research/non-bank-financial-institutions/fitch-affirms-tacirler-at-a-tur-outlook-stable-11-06-2024), providing investors with a transparent and reliable investment environment.

Tacirler Yatırım offers a wide range of services in the field of corporate finance, including acting as an intermediary for share offerings, acting as an intermediary for private sector debt instrument issuances, and providing merger and acquisition advisory services. Since 1991, Tacirler Yatırım has successfully led the public offerings of 10 companies with a total public offering size exceeding TL 6.2 billion on the Borsa Istanbul , Tacirler Yatırım has successfully led the public offerings of 10 companies with a total public offering size exceeding 6.2 billion TL. Furthermore, Tacirler Yatırım has provided over 29 billion TL in financing from the Capital Markets to its select corporate clients since 2014 alone, while also completing its own debt instrument issuance, which reached 3.3 billion TL in total by 2025.

Company Profile

| Aracı Kurumun Ticaret Unvanı | TACİRLER YATIRIM MENKUL DEĞERLER A.Ş. |

| Kuruluş Tarihi | 17/12/1990 |

| Ticaret Siciline Tescil Edildiği Yer | İSTANBUL TİCARET ODASI |

| Ticaret sicil No | 270946 |

| Mersis No | 0815006630900067 |

| Vergi Numarası | 815 006 6309 - Boğaziçi Kurumlar Vergi Dairesi |

| Merkez Adres | NİSPETİYE CAD. AKMERKEZ B3 BLOK K:9 ETİLER İSTANBUL |

| Telefon | 0 212 355 46 46 |

| Faks | 0 212 282 09 98 |

| destek@tacirler.com.tr |

Financial Data

Financial Data

According to TSPB data for June 2025, Tacirler Yatırım, with an asset size of 8.74 billion TL and a net asset size exceeding 3.61 billion TL, is accelerating its efforts to contribute to the Turkish capital market and economy. With its independent structure and leadership identity, it diversifies its services to transform today's changing risk perception into opportunities for investors, closely following technological developments and focusing on providing its customers with the latest technologies.

It is one of the largest minority shareholders of Takasbank with its 5% share in the capital of Takasbank.

Listed as one of the highest tax-paying institutions in its sector in the last 10 years; Tacirler Investment has received the "GOLD PLAQUE" award, which is the highest tax award, for 3 times and the "SILVER PLAQUE" award for 1 time.

Tacirler Holding Subsidiaries

- Tacirler Yatırım Menkul Değerler A.Ş.

- Tacirler Yapı Tekniği İnşaat Yatırım ve Tic. A.Ş.

- Tacirler Umumi Depoculuk ve Tic. A.Ş.

- Teriş Kimyevi Maddeler Tic. ve San. A.Ş.

- Pevsan PVC Granül San. ve Tic. A.Ş.

- Sümer Plastik ve Kağıt San. ve Tic. A.Ş.

- Uzel Plastik San. ve Tic. A.Ş

- Yücel-Ay Plastik İnş. Paz. San. Tic. A.Ş.

Financial Statements

2025

2024

2024

Tacirler Yatirim Menkul Degerler A S 31 Aralik 2024 Konsolide_pwc_final.pdf - 1.27 MB Tacirler Yatirim Menk Deg A S 31 12 2024 Faaliyet Raporu.pdf - 587 KB Tacirler Yatirim Menkul Degerler A S 30 09 2024 Konsolide.pdf - 996 KB Tacirler Yatirim Menk Deg A S 30 06 2024 Faaliyet Rapor_imzali.pdf - 566 KB Tacirler Yatirim Menkul Deg A S 31 Mart 2024.pdf - 963 KB Tacirler Yatirim Menkul Degerler A S 30 Haziran 2024 Konsolide_imzali.pdf - 1.4 MB2023

2023

Tacirler Yatirim Menkul Degerler A S 31 Aralik 2023 Konsolide Final.pdf - 1.08 MB İmzasiz_tacirler Yatirim Menk Deg A S 30 06 2023 Faaliyet Raporu 002.pdf - 352 KB İmzasiz_tacirler Yatirim Menkul Degerler A S 30 Haziran 2023 Final.pdf - 1.05 MB Tacirler Yatirim Menkul Degerler A S 30 09 2023 Konsolide Final.pdf - 1 MB Tacirler Yatirim Menkul Degerler A.s. 31 Mart 2023 Konsolide.pdf - 1.02 MB2022

2022

30.06.2022 Faaliyet Raporu.pdf - 280 KB 30.06.2022 Konsolide.pdf - 985 KB 31.03.2022 Konsolide.pdf - 1.1 MB Tacirler Yat R M Menkul Degerler A.s. 31 Aral K 2022 Konsolide.pdf - 1.14 MB Tacirler Yat R M Menkul Degerler A.s. 31.12.2022 Faaliyet Raporu Konsolide.pdf - 404 KB Tacirler Yatirim Menkul Degerler A.s. 30.09.2022 Konsolide.pdf - 1.06 MB2021

2021

31.03.2021 Konsolide.pdf - 1.12 MB Tacirler Yatirim Menk. Deg. A.s. 31.12.2021 Faaliyet Raporu.pdf - 386 KB Tacirler Yatirim Menkul Degerler A.s. 30.06.2021 Faaliyet Raporu.pdf - 389 KB Tacirler Yatirim Menkul Degerler A.s. 30.06.2021 Konsolide V3.pdf - 1.05 MB Tacirler Yatirim Menkul Degerler A.s. 30.09.2021 Konsolide.pdf - 1.27 MB Tacirler Yatirim Menkul Degerler A.s. 31.12.2021 Konsolide.pdf - 1.1 MB2020 ve Öncesi

2020 ve Öncesi

0101 3103 2016 Finansal Tablolar.pdf - 969 KB 0101 3112 2015 Finansal Tablolar.pdf - 862 KB 1 Ocak 30 Eylul 2016 Finansal Tablolar.pdf - 923 KB 1 Ocak 30 Haziran 2016 Finansal Tablolar.pdf - 751 KB 30.06.2013 Mali Tablolar.pdf - 871 KB 30.06.2015.mali.tablolar.pdf - 957 KB 30.06.2020 Faaliyet Raporu.pdf - 470 KB 30.06.2020 Konsolide.pdf - 1.21 MB 30.09.2015.mali.tablolar.pdf - 987 KB 30.09.2020 Konsolide Final.pdf - 1.21 MB 31.12.2009 Mali Tablolar.pdf - 2.43 MB 31.12.2010 Mali Tablolar.pdf - 781 KB 31.12.2011 Mali Tablolar.pdf - 863 KB 31.12.2012 Mali Tablolar.pdf - 853 KB 31.12.2013 Mali Tablolar.pdf - 1002 KB 31.12.2014.mali.tablolar.pdf - 892 KB 31.12.2020 Konsolide.pdf - 1009 KB Faaliyet Raporu 31.12.2020.pdf - 319 KB Final Tacirler Yatirim Menkul Degerler A.s. 31.12.2018.pdf - 629 KB Tacirler Yat R M Menk. De . A. . 31.12.2017 Kons Spk Tr.pdf - 830 KB Tacirler Yat R M Menk. De . A. . 31.12.2019 Faaliyet Raporu.pdf - 190 KB Tacirler Yat R M Menkul De Erler A. . 0317 Spk Tr 1.pdf - 993 KB Tacirler Yat R M Menkul De Erler A. . 30.09.2017 Finansal Rapor Spk Tr 000 1.pdf - 596 KB Tacirler Yat R M Menkul De Erler A. . 30.09.2018 Konsolide 31102018.pdf - 678 KB Tacirler Yat R M Menkul De Erler A. . 31.12.16 Spk Tr 1.pdf - 502 KB Tacirler Yat R M Menkul De Erler A. . 31.12.2019 Konsolide 28022020.pdf - 1.46 MB Tacirler Yatirim Faaliyet Raporu Ocak Haziran 30.06.2018 .doc.pdf - 201 KB Tacirler Yatirim Menk. Deg. A.s. 31.12.2020 Faaliyet Raporu.pdf - 221 KB Tacirler Yatirim Menk. Deg. A.s. Faaliyet Raporu Tmd 31.12.2017.pdf - 2.49 MB Tacirler Yatirim Menk.deg.a.s.faaliyet Raporu Ocak Haziran 2019.pdf - 288 KB Tacirler Yatirim Menkul Deg. A.s. Faaliyet Raporu Ocak Aralik 31.12.2018.pdf - 364 KB Tacirler Yatirim Menkul Degerler A.s. 30.06.2018 Konsolide Final Rapor.pdf - 871 KB Tacirler Yatirim Menkul Degerler A.s. 30.06.2019 Konsolide Final.pdf - 1.41 MB Tacirler Yatirim Menkul Degerler A.s. 30.06.pdf - 500 KB Tacirler Yatirim Menkul Degerler A.s. 30.09.2019 Konsolide.pdf - 1.62 MB Tacirler Yatirim Menkul Degerler A.s. 31.03.2018 Konsolide.pdf - 613 KB Tacirler Yatirim Menkul Degerler A.s. 31.03.2019 Konsolide.pdf - 1.54 MB Tacirler Yatirim Menkul Degerler A.s. 31.03.2020 Konsolide.pdf - 1.17 MBOur Management Staff

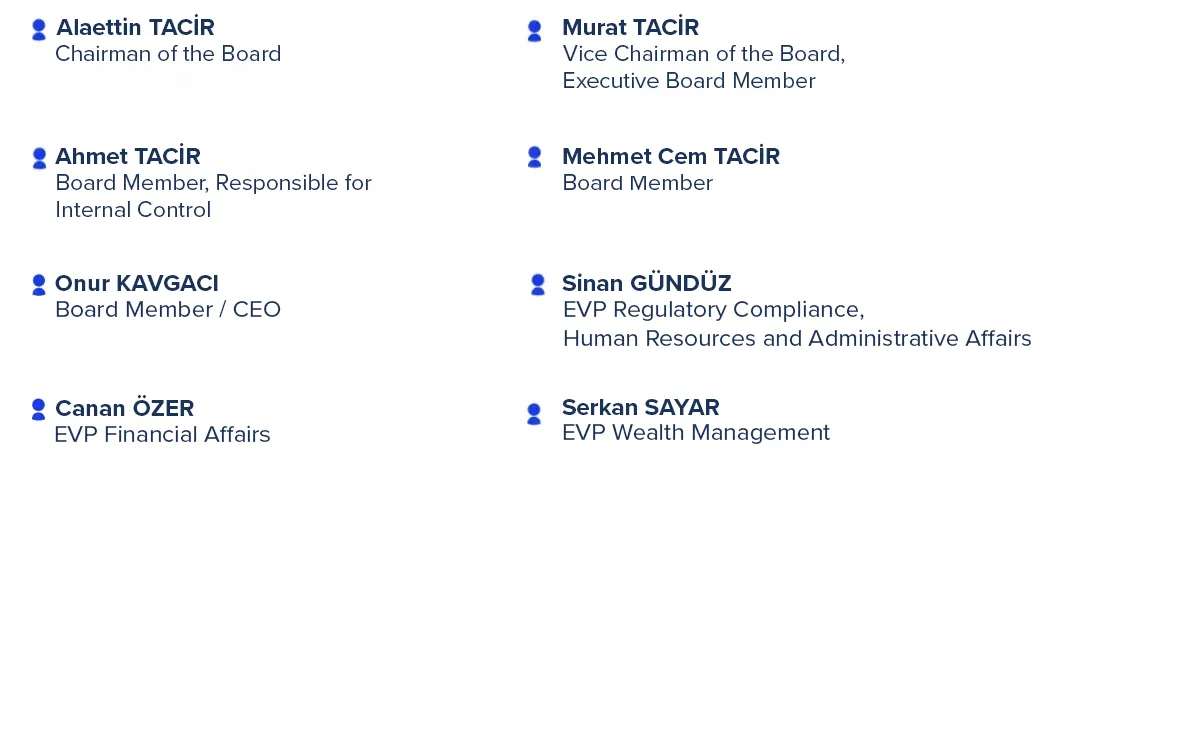

Our Management Staff

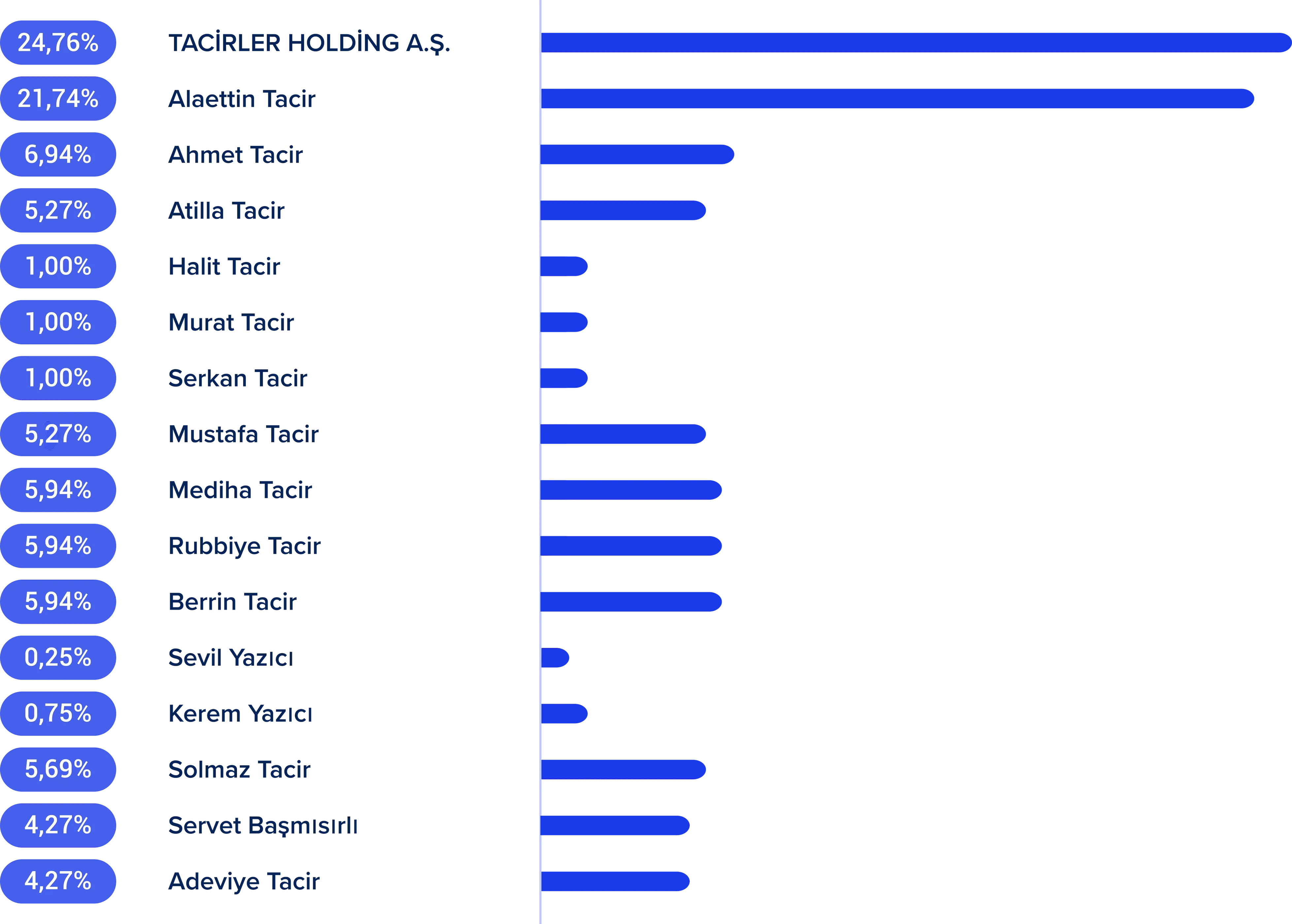

Our Shareholding Structure

Our Shareholding Structure