Over-the-Counter Derivative Products

Based on our specialized and experienced team, we, as Tacirler Investment, offer various derivative products in the Over-the-Counter Markets, defined as the markets other than stock exchanges and other organized markets, in line with the needs of our investors desiring to be protected against risks and invest under attractive conditions.

For the investment opportunities in the Over-the-Counter Derivative Products Markets: you can contact us at the telephone number (0212) 355 46 46 / 4617. Contact

You can find below the Underlying Assets, Trading Types and Margin Rates for our products and services offered for the Over-the-Counter Derivative Trades:

Underlying Assets

Underlying Assets

- Convertible Currencies - (USDTRY/EURTRY/EURUSD/USDJPY/GBPUSD...)

- Foreign Stock Exchange Indexes - (DOW JONES/DAX/S&P/NASDAQ/FTSE...)

- Foreign Stocks * - (IBM/BMW/GOOGLE/VODAFONE/VW...)

- Precious Metals and Commodities - (GOLD/SILVER/OIL/NATURAL GAS...)

- Republic of Turkey Treasury Bills / Government Bonds / Eurobonds / Private Sector Bonds

- Inflation Indexes and Indexes Accepted in International Markets - (CPI/PPI/BALTIC DRY INDEX...)

- Credit Default Swap Indicators - (CDSs for COUNTRIES AND COMPANIES)

*For the stocks traded on Borsa Istanbul A.Ş. and for the over-the-counter derivative transactions over the derivative instruments based upon the stocks traded on Borsa Istanbul A.Ş.; the legal regulations and limitations are complied.

Trading Types

Trading Types

| Transaction Type | Transaction Subject |

| SWAP | Currency Swap |

| Cross Currency Swap - (Cross Currency Swap) - plain / vanilla | |

| FORWARD | Forward - Forward Foreign Exchange |

| OPTION | Currency Call - Put Option |

| Interest Rate Call - Put Option | |

| Structured Deposit DCD (Dual Currency Deposit) | |

| Flat European Type Option | |

| Flat American Type Option | |

| Barrier Option | |

| Digital Options | |

| Ceiling Interest Rate Option (Cap) | |

| Floor Interest Rate Option (Floor) | |

| Stock Option | |

| Index Call - Put Option | |

| Other Call - Put Options |

Margin Rates

Margin Rates

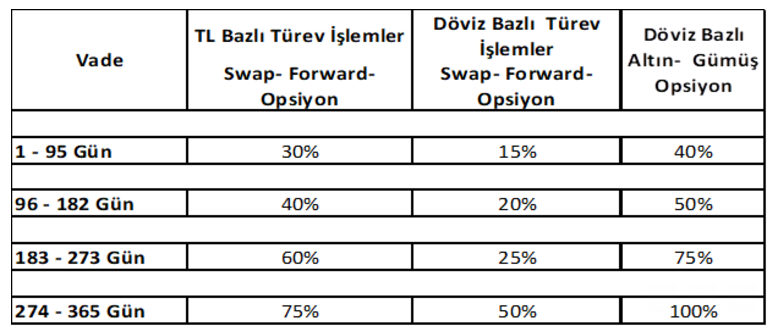

Initial Margin Ratios for Derivative Transactions

The collateral amounts below are initial margin amounts and in the event that these collateral amounts fall below 5% during the transaction, a margin call will be made to the client.

Margin Valuation Ratios

Margin Valuation Ratios

Collateral Type | Valuation Rate |

Turkish Lira**** | 100% |

GDDS | 90% |

Money Market and Debt Securities Umbrella Funds of Tacirler Portföy Yönetimi AŞ | 90% |

Tacirler Yatırım Financing Bonds/Bills | 90% |

Foreign Currency**** | 90% |

EUROBOND * | 80% |

BIST 30 | 80% |

Arbitrage Traded Hedge Funds of Tacirler Portföy Yönetimi AŞ (taking into account the period of exit from the fund) | 80% |

Private Sector Debt Instruments ** | 80% |

Money Market, Short-Term Debt Instruments Umbrella Funds traded on TEFAS | 80% |

Variable and Equity Umbrella Funds of Tacirler Portföy Yönetimi AŞ | 80% |

Debt Securities, Variable, Basket of Funds, Equity, Mixed, Participation, Precious Metals Umbrella Funds, Selected FREE Funds traded on TEFAS*** | 70% |

BIST 100 | 60 |

* Companies with an international credit rating from Fitch Ratings, Moody's or Standard and Poors equal to or one notch below the rating of the Republic of Turkey

** Companies with investment grade national credit ratings from Fitch Ratings, Moody's or Standard and Poors

***With the Executive Board decision dated 23.02.2024, among the Hedge Funds traded at Tefas, funds containing fixed income securities against foreign currency with a minimum of 80% of their content and a maximum of 1 year to maturity can be used as collateral. Money Market Hedge Funds can also be used as collateral.

**** Includes all demand and time deposit accounts held in customer sub-accounts at the banks where we work on an institutional basis.

The valuation rate of collaterals subject to physical delivery is 100%.

The valuation ratio will also be 100% if the same asset is pledged as collateral for the underlying derivative instrument.